Direct written premiums within the U.S. householders insurance coverage market rose greater than 13 % in 2024, and the online mixed ratio for the road fell under breakeven for the primary time in 5 years.

Increased costs defined a lot of the industrywide loss and mixed ratio enhancements, however not all householders insurers grew premiums final yr, a brand new report from S&P International Market Intelligence reveals.

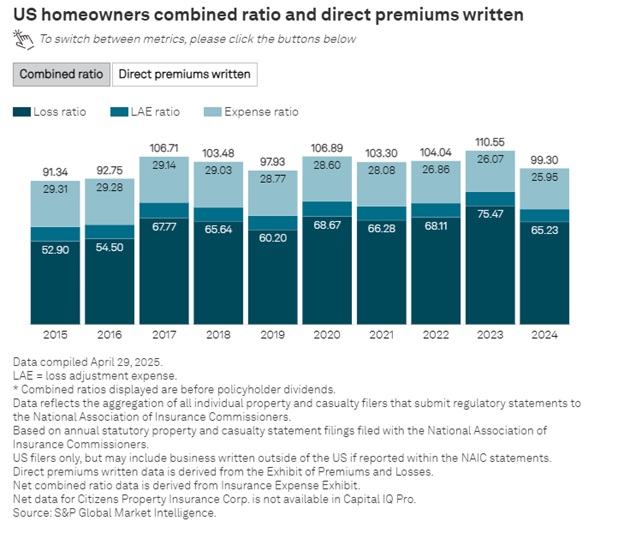

The brand new report, “Premiums rise, ratios recede for U.S. householders insurers in 2024,” exhibits that regardless of 5 tropical cyclones and quite a few extreme climate occasions, the industrywide internet mixed ratio for householders (excluding policyholder dividends) was 99.3 in 2024, 11.2 factors higher than the 110.5 ratio recorded in 2023.

The 99.3 marked the primary time since 2019 that the ratio was under 100, the report stated.

(Editor’s Word: Earlier this month, Provider Administration reported on a separate report from S&P GMI in an article titled “2024 P/C Insurance coverage Mixed Ratio: Finest in Extra Than a Decade,” which confirmed the householders internet mixed ratio touchdown at 99.7 final yr. The 2024 mixed ratio within the prior report included policyholder dividends. The newest report on simply the householders line doesn’t.)

The report exhibits industrywide householders internet mixed ratios (together with loss ratio and expense parts) for the final decade on an interactive chart, which additionally gives tallies of direct written premiums and year-over-year premium jumps for annually from 2015-2024. General, direct premiums written within the sector rose 13.4 % to just about $173.1 billion. The rise marked the second-highest since 2015, behind a 14.1 % leap recorded in 2023.

The nationwide common rise in owner-occupied home-owner charges in 2024 rose to 11 % from 9.7 % in 2023, in accordance with Market Intelligence’s RateWatch software, the report stated.

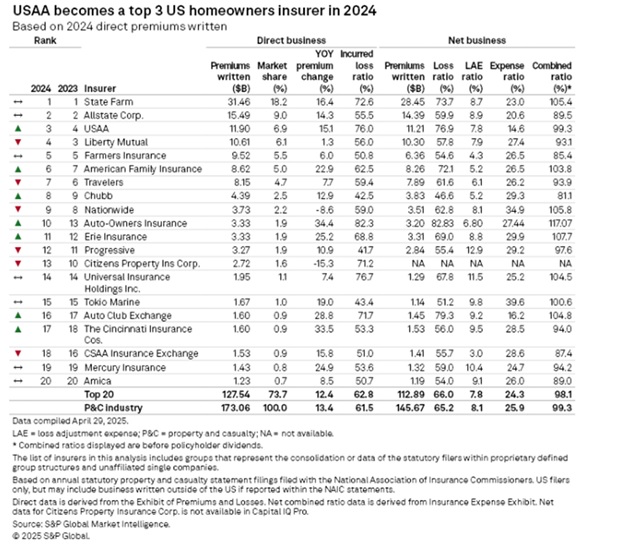

A rating of the highest 20 householders insurers based mostly on direct written premium quantity exhibits the three largest gamers—State Farm, Allstate and USAA—every rising by double digits and reporting improved mixed ratios. However regardless of what S&P GMI calculates to be a 16.4 % bounce in direct premiums to $31.5 billion for the yr, State Farm’s internet mixed ratio remained above 100, ending up at 105.4.

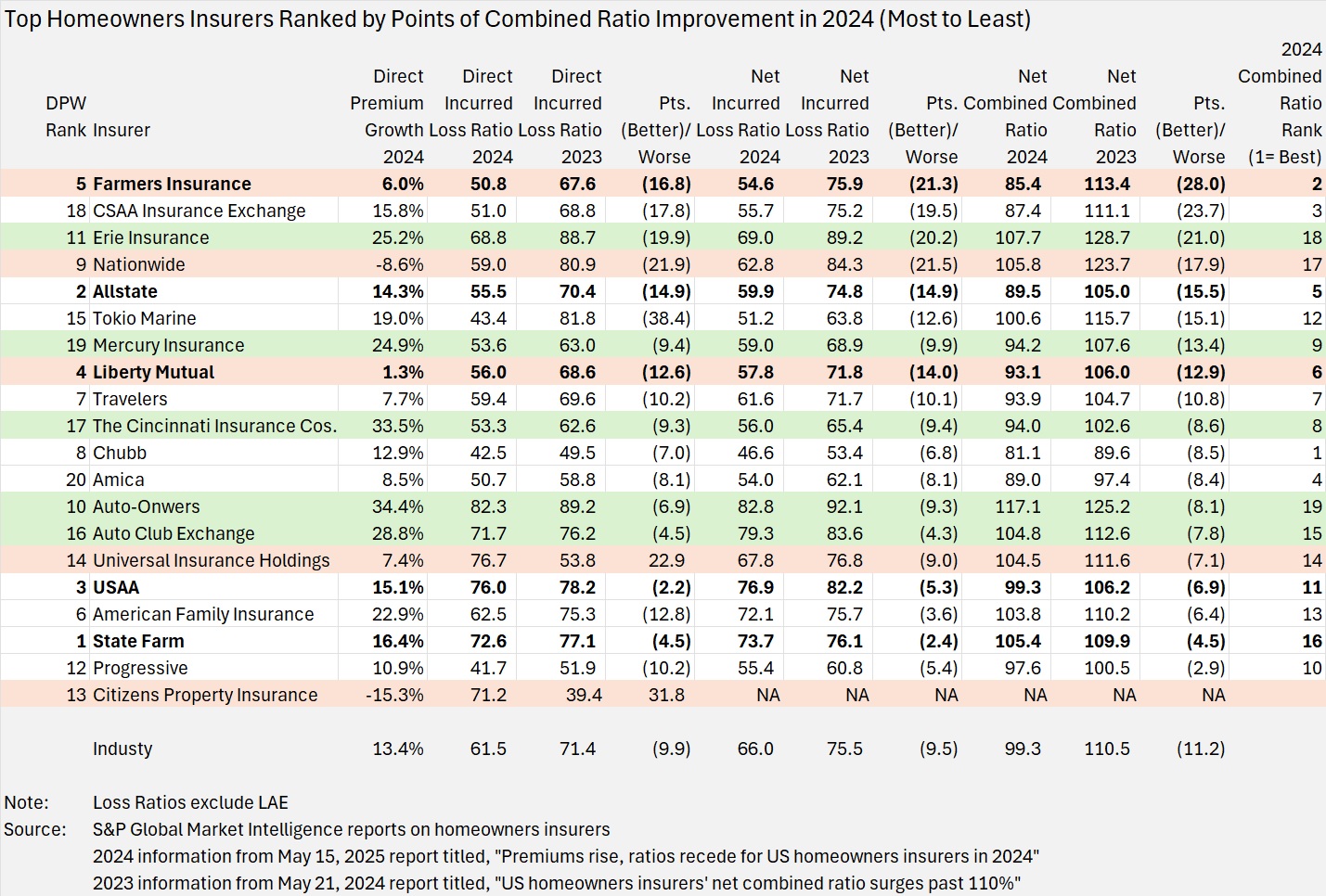

A comparability of particular person service direct incurred loss ratios displayed within the newest S&P GMI report about householders insurance coverage outcomes with these set forth for a similar 20 insurers in the same report printed in Could final yr reveals that State Farm and USAA had the smallest direct loss ratio enhancements among the many 18 that reported higher ends in 2024 (4.5 factors for State Farm and a pair of.2 factors for USAA).

Solely two Florida regional insurers—Residents Property Ins. Corp. and Common Insurance coverage Holdings Inc.—reported deteriorating loss ratios for 2024.

Specializing in internet mixed ratio enhancements (after the impacts of reinsurance) as an alternative of direct loss ratio modifications, State Farm and USAA nonetheless rank close to the underside. (Chart produced by Provider Administration under shows the 20 insurers ranked by factors of mixed ratio enchancment from 2023 to 2024.)

Two different massive householders insurers—Farmers and Liberty Mutual—posted the smallest development charges among the many 18 that reported extra direct written premiums in 2024 than 2023. In distinction to State Farm and USAA, nonetheless, these two corporations rank amongst these with essentially the most improved mixed ratios, probably benefiting from initiatives to shrink their portfolios as they elevated charges.

Farmers, rising premiums by simply 6 %, noticed its internet mixed ratio enhance by 28 factors to 85.4 in 2024. (That was the second greatest mixed ratio consequence among the many prime 20 carriers. Chubb posted an 81.1 internet mixed ratio.)

In the meantime, Auto-Homeowners, which recorded the biggest 2024 direct premium development charge among the many 20 largest carriers at 34.4 %, additionally ended up with the worst mixed ratio, 117.1.

Nationwide Mutual Insurance coverage Co., the one firm among the many prime 10 largest householders to file decrease premiums in 2024 than 2023—a drop of 8.6 % to only over $4 billion—nonetheless recorded 17.9 factors of mixed ratio enchancment. The improved ratio, nonetheless, remained above breakeven in 2024 at 105.8.

Residents Property Insurance coverage Corp. was the one different insurer among the many prime 20 to file a decline in direct premiums written final yr. The 15.3 % drop to $3.2 billion for Residents pushed Florida’s insurer of final resort out of the highest 10 to a Thirteenth-place rating based mostly on premium quantity. The S&P GMI report attributes this to the success of depopulation efforts. Nonetheless, Residents was certainly one of solely two insurers listed within the S&P GMI report back to file worse direct underwriting ends in 2024 than 2023—with its direct incurred loss ratio greater than 30 factors greater than the one listed in the same report printed by S&P GMI in Could 2024 laying out 2023 outcomes.

Florida-based Common Insurance coverage Holdings additionally noticed its direct loss ratio deteriorate by greater than 20 factors, however its internet mixed ratios confirmed enchancment, after the influence of reinsurance. (Web mixed ratios for Residents weren’t accessible within the S&P GMI reviews.)

Florida, nonetheless, didn’t produce the worst loss ratio outcomes for insurers in 2024.

The newest report additionally features a U.S. map color-coded to point the states with the worst and greatest industrywide direct loss ratios. Nebraska, which was impacted by tornadoes and hail in two separate storms final June, had the best direct loss ratio—136.6 (together with loss adjustment bills).

Excited by Carriers?

Get computerized alerts for this subject.