By Mary Searnade Written, Sieska Senemed, and Elwyn Panggabean

In a busy nook of a Jakarta suburb, Atin, 36, retains a gentle rhythm. Between racks of garments and cabinets of magnificence merchandise, she runs a bodily retailer with six workers and manages three on-line shops. Orders are available in all through the day, some from loyal customers, others from new clients scrolling by way of their feeds. It’s a fast-paced, typically unpredictable routine, however Atin sees momentum constructing. She’s working towards launching her personal model, one step at a time. Her story displays the each day actuality of many Indonesian girls entrepreneurs: adapting, planning forward, and steadily carving out an area in a fast-moving digital market.

This shift is mirrored in Indonesia’s increasing e-commerce market, anticipated to achieve $169 billion by 2032, with girls contributing an estimated $74 billion. Extra than simply an financial pattern, it marks a step ahead in girls’s monetary inclusion and independence. As highlighted in UNEP FI’s Gender Equality Steeragemonetary providers designed with girls’s wants in thoughts can strengthen their capacity to handle uncertainty and construct long-term resilience.

Recognizing this, Ladies’s World Banking has partnered with SeaBank Indonesia since 2024 to develop women-centered monetary merchandise. By addressing limitations like low consciousness, security issues, and poorly focused messaging, the partnership goals to make digital banking extra accessible and related for girls.

Understanding girls entrepreneurs

Ladies personal 64% of Indonesia’s MSMEs and generated 35% of on-line commerce income pre-pandemic, but nonetheless earn 22% lower than males and infrequently lack confidence in monetary administration (McKinsey).

SeaBank helps over a million outlets, with 45% women-owned; nevertheless, many ladies use accounts just for fee reception relatively than complete monetary providers.

Our analysis recognized three major profiles of girls e-commerce entrepreneurs:

- Pure-digital strategists: On-line-native sellers who save strategically for enterprise enlargement and emergencies.

- Hybrid commerce sellers: Disciplined savers who use time deposits for each enterprise and household wants.

- In-store innovators: Transitioned from offline to on-line, often saving by way of diversified strategies, together with property like gold.

Regardless of differing habits, all prioritize safety, comfort, cost-effectiveness, ease-of-use, and relevance in monetary providers. Suppliers should thus supply tailor-made providers, lowered transaction charges, and simplified account processes to draw and retain girls entrepreneurs.

Designing a monetary answer for girls

Based mostly on these insights, SeaBank is addressing the precise challenges that stop girls e-commerce sellers from utilizing its digital financial savings options. The purpose is to assist girls handle their enterprise funds extra successfully, whereas positioning SeaBank as a trusted monetary companion. It additionally encourages girls to undertake good monetary practices in each their enterprise and private lives, serving to them to construct stronger monetary resilience.

The answer is grounded in 4 women-centered design methods:

1. Design for cognition: enhancing consciousness

Many ladies sellers are unfamiliar with digital banking instruments or uncertain of their relevance. We simplify monetary language into relatable messages and guarantee constant communication throughout platforms girls already use. Visuals and wording are crafted to resonate particularly with girls entrepreneurs.

Examples of observe:

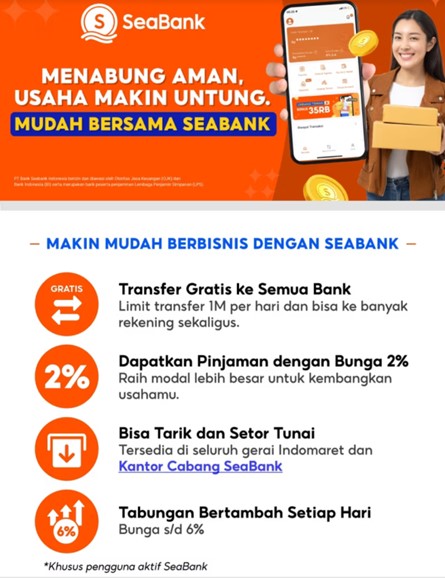

- Up to date advertising supplies that spotlight the comfort and price advantages of SeaBank’s cell banking options

- Clear in-app messaging throughout SeaBank’s digital ecosystem, positioning the app as a complete monetary device—not only a fee gateway

Advertising property that entice girls clients

2. Design for belief: constructing credibility

Safety and reliability are prime issues. To handle this, we showcase actual experiences of girls MSME house owners who use SeaBank, reinforcing belief by way of genuine testimonials.

Examples of observe:

- Sharing testimonial movies by way of social media and vendor communities

- That includes trusted symbols such because the OJK and LPS logos, and selling SeaBank’s responsive contact heart for situation decision

3. Design for accessibility: driving engagement

Ladies’s engagement with monetary providers may be elevated by making options intuitive, rewarding, and related to their on a regular basis wants.

Examples of observe:

- Gamified options tied to each day monetary actions (reminiscent of funds and withdrawals) to make studying and utilizing the app participating and acquainted

- Sub-accounts that assist separate enterprise and private funds, supporting clearer psychological budgeting and financial savings habits

- On-line and offline coaching periods that cowl monetary and enterprise matters, constructing confidence and expertise to handle enterprise progress

4. Design to be used: encouraging digital financial savings

We help girls in transferring from casual to digital financial savings by making their progress seen and actionable. Actual-time monitoring builds a way of management and motivation to avoid wasting constantly.

Examples of observe:

- Automated reviews that present complete financial savings and fee-free transactions, serving to girls visualize their monetary progress and the worth of digital banking

Taking girls entrepreneurs to the subsequent stage

Our work with SeaBank highlights how gender-intentional design helps girls entrepreneurs develop into extra resilient and prepared for progress.

- Higher monetary administration

Ladies e-sellers extremely valued our interactive coaching periods, with 100% discovering them efficient and recommending them to their friends. These periods outfitted sellers with sensible expertise to handle their funds and develop their companies.

- Elevated account engagement

Ladies-centered designs led to elevated account exercise, with as much as 19% extra sellers actively making withdrawals after receiving customized financial savings reviews throughout our pilot with round 700 girls sellers. This engagement signifies that girls entry and management their financial savings extra often, which immediately builds their monetary resilience by serving to them to higher address monetary shocks and uncertainties.

Our pilot with SeaBank clearly demonstrates that considerate, tailor-made options can considerably enhance the way in which girls entrepreneurs use monetary providers to develop their companies. To additional empower girls entrepreneurs, monetary establishments should proceed to innovate and supply focused options that assist girls attain the subsequent stage of enterprise success. It will create stronger, lasting relationships that profit each girls entrepreneurs and monetary service suppliers.

This publication is funded by (or partly by) the Gates Basis. The findings and conclusions contained inside are these of the authors and don’t essentially mirror positions or insurance policies of the Gates Basis.