That is the second in a three-part collection inspecting a contemporary strategy to digital remittances in Indonesia.

Belqual, I am Not Afint, Planowing Eveccies.

For home staff in Indonesia, remittances present a important technique of help for his or her households. As we famous in our first webloghome staff want safe and assured supply of funds when selecting a remittance channel; nonetheless, many find yourself selecting casual and dangerous channels (for instance, via retailers and in money with individuals who journey again residence), which might result in theft and fraud. As such, Girls’s World Banking partnered with DANAone in every of Indonesia’s largest e-wallet suppliers, to develop a digital remittance answer for home staff to securely ship cash to their households and to extend their engagement with formal monetary companies.

Understanding what’s most vital for home staff and their recipients

To help within the design and supply of our digital remittance service, we carried out in-depth interviews to grasp the limitations, challenges, and wishes of home staff in Indonesia when choosing and utilizing remittance channels and companies. Regardless of their frustrations with present remittance channels and companies (via money, counters, and casual channels), home staff understand these as the one choices out there to them. After we requested home staff what a super remittance service would seem like, they reported a service that’s quick and straightforward to make use of, dependable, and accessible (each for them and their recipients):

- Quick and straightforward: Home staff are time-poor and want a service that gives quick and straightforward transactions, with close by easy-to-access service touchpoints. Moreover, they want a service that makes funds immediately out there for recipients, one that’s simple to transact with and requires few steps, and one with shorter processing occasions, permitting staff to maximise their free time.

- Dependable: Staff are sending massive lump sums of money residence and like a service that may assure supply with low threat of theft and fraud. Some have reported selecting a channel with increased service charges for the sake of quicker, assured supply of their funds as in comparison with cheaper, slower strategies.

- Accessible: As a result of many staff’ households stay in rural and distant areas of Indonesia, a service with accessible touchpoints for cash-out is important. A service that’s simple for digitally and tech illiterate clients creates much less trouble for the cash-in and cash-out course of.

Key limitations and challenges to digital remittances for home staff

An e-wallet service and platform can present a remittance channel that’s quick and straightforward, dependable, and accessible for each senders and recipients. Furthermore, it could actually present clients with their first formal account within the type of e-wallets and construct their monetary and digital monetary capabilities, permitting them to turn into complicated and multi-case customers. However to spice up inclusivity within the e-wallet market, we should first handle home staff’ commonest limitations and challenges in utilizing e-money and digital wallets as a remittance channel:

- Advanced/sophisticated sign-up course of: Staff want help to finish the registration course of, particularly with digital verification procedures reminiscent of e-KYC (know your buyer)

- Lack of entry to web/information: Poor infrastructure in distant areas creates connectivity points or lack thereof, stopping senders and recipients from utilizing e-money and digital wallets

- Lack of use circumstances/underdeveloped digital ecosystem: The absence of a digital ecosystem in rural and distant areas limits transactions

- Overwhelming app selections/interface: Overloaded UX/UI makes navigating an app too sophisticated for digitally illiterate clients

- Lack of belief in digital/e-money: Because of inexperience (or restricted consciousness) and/or a earlier expertise dropping cash, staff are reluctant to depend on e-money and digital wallets

- Worry of creating errors: Digitally illiterate clients are reluctant to depend on e-money and digital wallets within the occasion they make expensive errors, reminiscent of inputing the fallacious account quantity or cash quantity

Designing an answer that works for home staff

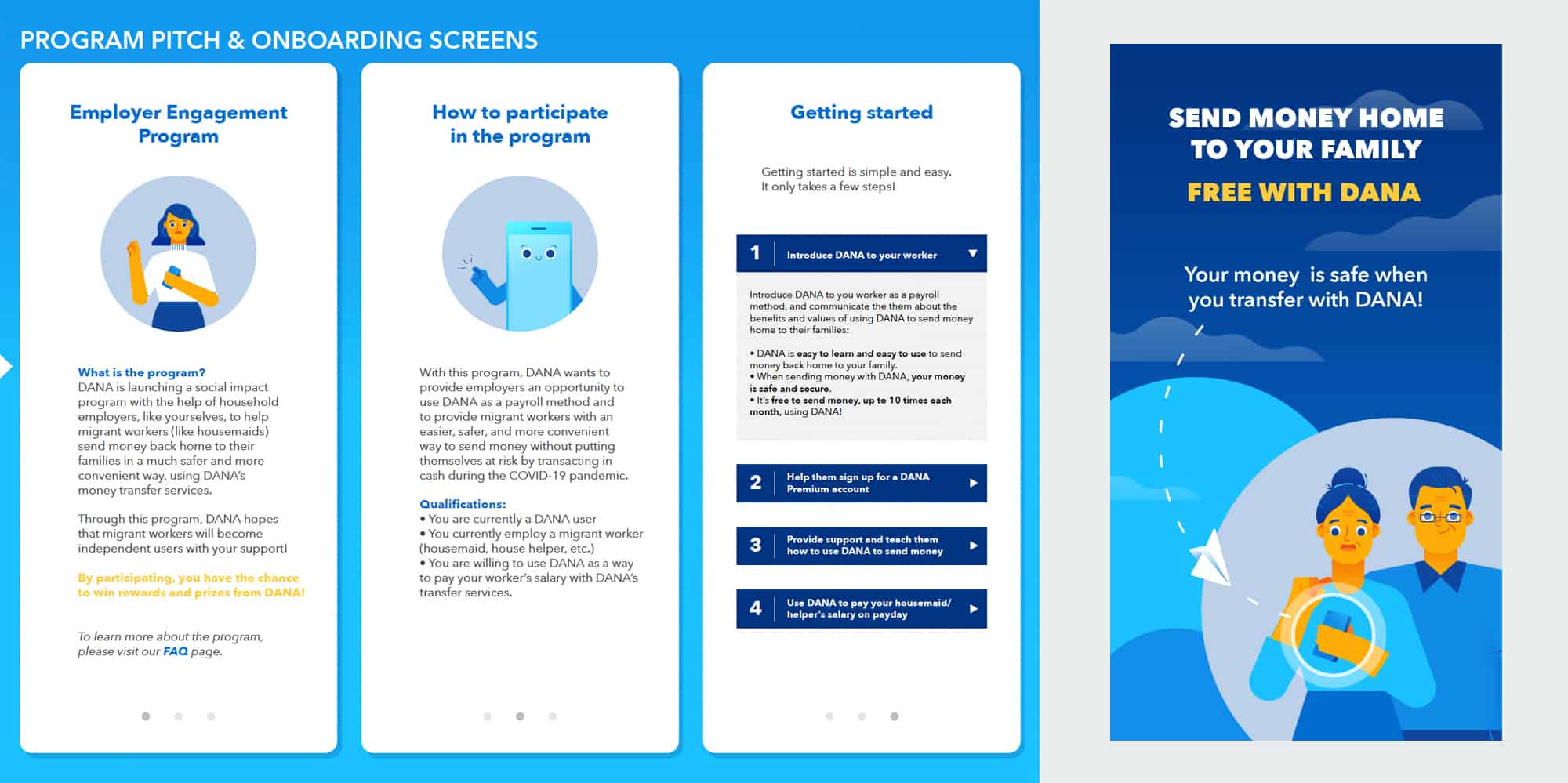

As a result of there are not any central and formal aggregators for Indonesia’s home staff, it’s almost unattainable to succeed in the home employee inhabitants. As such, we designed and developed a totally digital answer that leverages DANA’s present customers, who’re additionally employers of home staff. DANA customers/employers thus play a key position in introducing DANA as a payroll technique and as a viable, protected, and dependable remittance service for staff.

Aimed toward constructing the digital and monetary capabilities of home staff, DANA’s five-part answer teaches them learn how to use the digital platform to make remittance transfers. First, we construct consciousness amongst employers and home staff of DANA and its account advantages by establishing DANA as an accessible, reliable, and easy-to-use remittance channel. To assist clients overcome the hurdles of account registration and the difficult KYC verification course of, we enlist employers to help home staff in signing up for DANA Premium accounts. We then present staff with alternatives to be taught and apply learn how to transact with DANA. Telephone notifications and reminders, along with gamification and different incentives, assist encourage staff to make use of DANA as a remittance service to ship cash residence. An outline of the answer parts is as follows:

- Program pitch and onboarding: Promote this system amongst employers and home staff and construct belief and confidence in DANA as a remittance service by speaking its values and advantages.

- Transaction tutorials: Present step-by-step visible guides to assist home staff who’re much less tech savvy discover ways to make transactions with their DANA accounts and supply alternatives for them to apply.

- Key buyer advertising and messaging: Develop advertising supplies for purchasers with messaging that communicates the important thing worth and advantages of utilizing DANA and emphasizes that the service is straightforward, handy, protected, and safe.

- Well timed notifications and reminders: Ship notifications and reminders round payday to maintain DANA high of thoughts for purchasers and increase the usage of DANA to ship cash residence.

- Gamification and incentives: Use gamification to assist clients ship remittances and full different transactions on DANA’s e-wallet platform and supply related incentives and rewards to encourage clients who efficiently attain milestones.

Piloting the answer and subsequent steps

In September 2021, we launched a three-month check pilot of the answer, out there to all of DANA’s KYC and non-KYC clients. With this program pilot, we hope to grasp:

- How nicely did the answer attain home clients, and what number of staff had entry to the answer (obtained promotional, advertising, and related program supplies and communications)?

- What number of ladies home staff accessed the answer total and began utilizing DANA’s remittance companies to ship a reimbursement residence?

Based mostly on the outcomes and learnings of the pilot, we’ll iterate and modify the answer as wanted earlier than rolling-out to DANA’s whole buyer base. In Half 3 of this weblog collection, we’ll share our learnings from this system pilot, in addition to our suggestions to successfully design and attain home migrant staff with a digital remittance answer.