(Up to date on July 5, 2025.)

I’ve been shopping for medical insurance on an change underneath the Reasonably priced Care Act (ACA) since 2018. Earlier than the ACA, getting well being care protection was one of many greatest challenges for turning into self-employed. Neglect about the associated fee — simply getting a coverage was a problem by itself. ACA modified all that. Now self-employed folks and others who don’t get medical insurance by way of their jobs should buy medical insurance from the ACA change.

Not solely can you purchase medical insurance, however the protection can also be made extra inexpensive by the premium subsidy within the type of a tax credit score. How a lot tax credit score you get is calculated off of your modified adjusted gross earnings (MAGI) relative to the Federal Poverty Degree (FPL) to your family dimension.

MAGI for ACA

Your MAGI for ACA is mainly:

- Your gross earnings;

- minus pre-tax deductions from paychecks (401k, FSA, …)

- minus above-the-line deductionsfor instance:

- pre-tax conventional IRA contributions

- HSA contributions

- 1/2 of self-employment tax

- pre-tax contribution to SEP-IRA, solo 401k, or different retirement plans

- self-employed medical insurance deduction

- pupil mortgage curiosity deduction

- plus tax-exempt muni bond curiosity;

- plus untaxed Social Safety advantages

Wages, curiosity, dividends, capital positive aspects, pension, withdrawals from pre-tax conventional 401k and IRAs, and cash you change from Conventional to Roth accounts all go into the MAGI for ACA. Muni bond curiosity and untaxed Social Safety advantages additionally rely within the MAGI for ACA.

Aspect observe: There are a lot of totally different definitions of MAGI for various functions. These totally different MAGIs embody and exclude totally different parts. We’re solely speaking concerning the MAGI for ACA right here.

2021-2025: 400% FPL Cliff Modified to a Slope

Your tax credit score goes down as your earnings will increase. Up by way of the yr 2020, the tax credit score dropped to zero when your MAGI went above 400% of FPL. In case your MAGI was $1 above 400% FPL, you’ll pay the complete premium with zero tax credit score. Individuals needed to be very cautious in monitoring their earnings to ensure it didn’t go over the cliff.

Legal guidelines modified throughout COVID, and for 5 years solely — 2021 by way of 2025 — this cliff turned a slope. The tax credit score continued to drop as your earnings elevated, however it didn’t all of the sudden drop to zero when your earnings went $1 over the cliff.

The tax credit score additionally elevated barely throughout all earnings ranges, however eradicating the cliff was an enormous aid to folks with an earnings greater than 400% of the FPL ($81,760 in 2025 for a two-person family within the decrease 48 states).

The Cliff Returns in 2026

The brand new 2025 Trump tax legislation — One Large Stunning Invoice Act — didn’t do something to increase the slope remedy. The 400% FPL cliff is scheduled to return in 2026.

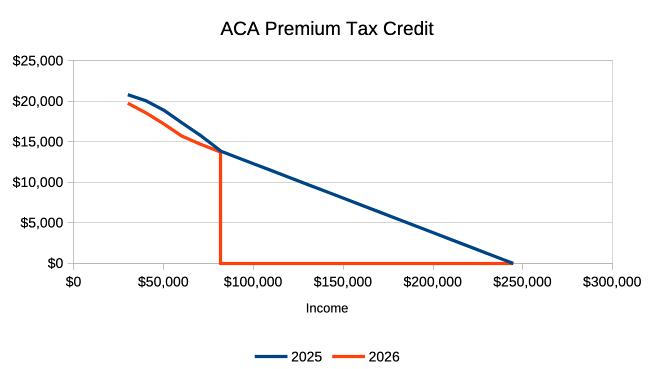

The chart above exhibits the ACA premium tax credit score at totally different earnings ranges for a family of two folks within the decrease 48 states with the U.S. common medical insurance prices. The blue line is for 2025 with the slope. The pink line is for 2026 with the cliff, assuming that medical insurance prices will keep the identical. The hole between the 2 strains represents the change from a slope to a cliff.

The premium tax credit score will drop barely earlier than the 400% FPL cliff. It goes down by about $1,100 at a $70k earnings, however the drop is precipitous on the cliff. We’re speaking about receiving over $13,000 in 2025 versus $0 in 2026 for a two-person family with an earnings of $85k.

Know Your Cliff

How do you provide you with $13,000 further for medical insurance with an earnings of $85,000?

You need to handle your earnings to maintain it underneath the cliff. The very first thing to know is the place precisely the cliff is.

For a family of a single particular person within the decrease 48 states, the 400% FPL cutoff is $62,600 in 2026. For a family of two folks within the decrease 48 states, the cutoff is $84,600 in 2026. See Federal Poverty Ranges (FPL) For Reasonably priced Care Act for the place the FPL is to your family dimension. Multiply it by 4 to get your cliff.

Handle Your Earnings

The subsequent most crucial half is to mission your earnings all year long and never understand earnings willy-nilly earlier than you do the projection. If you end up near the cliff earlier than you understand earnings, you may nonetheless alter. Many individuals are caught unexpectedly solely after they do their taxes the next yr. Your choices are way more restricted after the yr is over.

You’ve got some management over staying underneath the cliff once you depend on an funding portfolio for earnings. If you find yourself underneath 59-1/2, you’re primarily spending cash out of your taxable accounts. A big a part of the cash withdrawn is your individual financial savings; the remainder is curiosity, dividends, and capital positive aspects. Spending your individual financial savings isn’t earnings. For those who withdraw $60k from a taxable account to dwell on, your MAGI isn’t $60k. It’s in all probability lower than $30k.

Check out the MAGI definition. Reduce something that raises your MAGI and maximize the whole lot that lowers your MAGI.

Once you complement your earnings with part-time self-employment, you continue to have the choice to contribute to pre-tax conventional 401k, IRA, and HSA. These pre-tax contributions decrease your MAGI, which helps you keep underneath the 400% FPL cliff.

However, Roth conversions and withdrawals from pre-tax accounts improve your MAGI. You ought to be cautious with doing these once you’re making an attempt to remain underneath the 400% FPL cliff.

100% and 138% FPL Cliff

There’s one other cliff on the low facet, though that one is well overcome when you have retirement accounts.

In an effort to qualify for a premium subsidy for getting medical insurance from the ACA change, you will need to have earnings above 100% of FPL. In states that expanded Medicaid to 138% of FPL, you will need to additionally not qualify for Medicaid, which suggests you will need to have MAGI above 138% of FPL.

These are checked solely on the time of enrollment. When you get in, you’re not punished in case your earnings unexpectedly finally ends up under 100% or 138% of FPL. For those who see your earnings is susceptible to falling under 100% or 138% FPL, convert some cash out of your Conventional 401k or Conventional IRA to Roth. That’ll increase your earnings above 100% or 138% of FPL.

Say No To Administration Charges

If you’re paying an advisor a proportion of your property, you might be paying 5-10x an excessive amount of. Learn to discover an unbiased advisor, pay for recommendation, and solely the recommendation.