The U.S. surplus strains market notched double-digit year-over-year (YoY) premium development from 2018-2023, as wholesale brokers tapped this market with better frequency to discover protection options for companies amid increasing dangers.

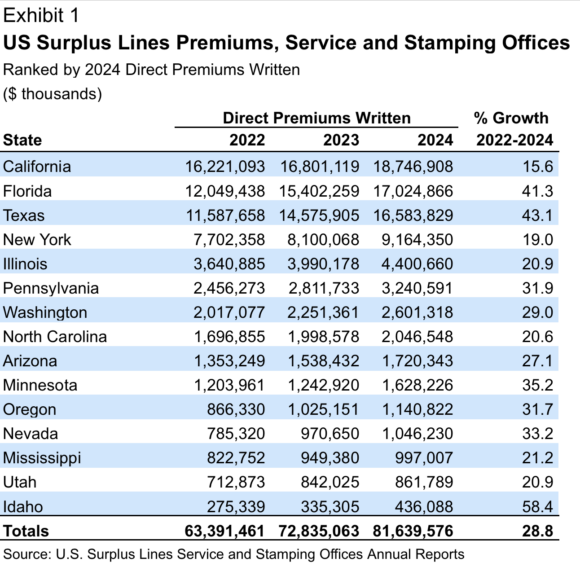

The magnitude of the YoY development peaked at 30% in 2021, primarily based on information compiled by AM Finest. The U.S. surplus strains and stamping workplaces detailed the continuation of premium momentum, highlighting a 12.1% YoY premium improve in 2024 for surplus strains’ insurers reporting information to the 15 particular person state service and stamping workplaces nationwide. Throughout the final full three years from 2022-2024, premiums produced by the service and stamping workplaces elevated by 28.8%.

A number of segments have been key in contributing to the expansion in premiums generated by surplus strains—or non-admitted—insurers within the three-year interval, together with strains straight experiencing turbulence post-COVID from macroeconomic pressures.

“Surplus strains writers have collectively been offering a better share of market protection for among the similar strains which have generated unfavorable underwriting outcomes for the general P/C business throughout the previous decade.”

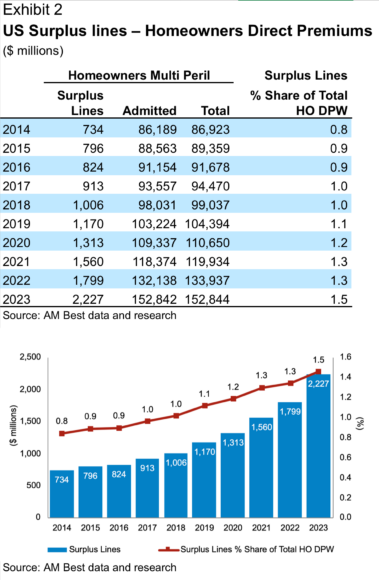

Though private strains protection, particularly owners’ insurance coverage, stays a comparatively small a part of the general surplus strains market, elevated writings in that section have contributed to the constant surplus strains premium development. Many states, along with a number of strains of enterprise, have been key contributors to this momentum.

Largest States Drive Premium Progress

4 states that constantly account for the most important share of U.S. surplus strains direct premium written (DPW) yearly—California, Florida, Texas, and New York—additionally generate nearly all of whole property/casualty (P/C) insurance coverage direct premium. The primary three states referenced every generated over $16 billion in surplus strains premium for the yr, with New York lagging behind, comparatively, at $9.1 billion (see Exhibit 1 under). In 2024, these states produced over 75% of whole U.S. surplus strains DPW, primarily based on the companies and stamping workplaces information.

Even earlier than the devastating California wildfires initially of this yr, excessive climate in 2023 and 2024, together with heavy rains that subsequently yielded mudslides, created unfavorable outcomes for owners’ and industrial property insurers providing protection within the state, considerably affecting underwriting ends in these years.

Subsequently, some admitted insurers reassessed their urge for food for property enterprise and pushed extra of it into the excess strains market. California’s property insurance coverage market is more likely to face extra challenges within the close to time period, and surplus strains’ insurers may very well be known as upon to fill provide gaps as extra admitted insurers develop into more and more even handed with their market capability in particular areas of the state. If this happens, it will be just like market dynamics in Florida and Louisiana following the impression of elevated weather-related losses earlier this decade.

Troubled Protection Strains Present Alternatives

Volatility within the underwriting outcomes for property insurers has led to the upper coverage pricing for each industrial and private strains property companies. Whereas surplus strains writers haven’t traditionally targeted a lot on private strains enterprise, they generated 1.5% of U.S. owners’ DPW in 2023, reaching the best stage throughout the decade and surpassing the $2 billion mark for the primary time (see Exhibit 2 under).

AM Finest expects that after 2024 surplus strains information is absolutely aggregated, it is going to reveal a continuation of the development. Surplus strains’ insurers have had the pliability to fulfill demand throughout powerful markets, which has led to surplus strains’ owners’ premium greater than doubling over the past six years, from $1.0 billion in 2018 to $2.2 billion in 2023.

Throughout this time, the P/C business’s year-over-year owners market profitability has exhibited a higher-than-normal stage of volatility. Line of enterprise premium information serves as an indicator of the varieties of enterprise being provided within the surplus strains market throughout any given interval.

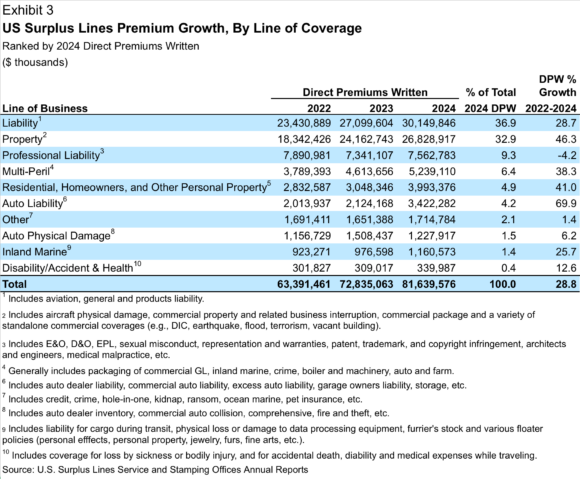

From 2022 by 2024, surplus strains service workplace information revealed that whole surplus strains premium grew by 28.8% (see Exhibit 3 under).

Casualty strains of enterprise embrace basic legal responsibility, merchandise legal responsibility, umbrella and extra legal responsibility protection. AM Finest has discovered that basic legal responsibility coverages constantly mixed to signify the most important portion of the excess strains market from a DPW perspective.

Preliminary information aggregation for 2024 signifies an nearly 10 share level deterioration within the P/C business’s web incurred loss ratio for the opposite legal responsibility (incidence) protection line, which represents the bigger of the 2 basic legal responsibility protection strains. The mixture of basic legal responsibility (36.9%) and industrial property (32.9%) protection represented nearly 70% of surplus strains market premium written by the service and stamping workplaces during the last three years.

Industrial property included enterprise interruption protection related to industrial property insurance policies, along with standalone coverages, together with however not restricted to distinction in situations, earthquake, flood and terrorism. No different protection accounted for as a lot as 10% of the excess strains market. The development displaying rising premium development underscores the excess strains market’s skill to adapt to shifting calls for, using its freedom of charge and type to supply protection for troubled danger courses and contours of protection when admitted market carriers show reticence to do the identical.

Selective Progress in Adversely Trending Strains

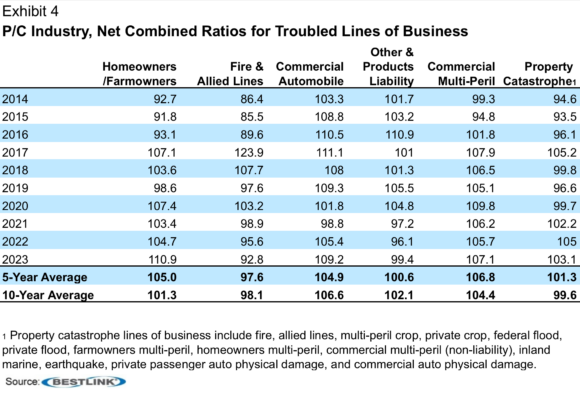

Surplus strains writers have collectively been offering a better share of market protection for among the similar strains which have generated unfavorable underwriting outcomes for the general P/C business throughout the previous decade. For many of those strains, business underwriting outcomes have been trending poorly and have exhibited notable volatility lately (see Exhibit 4 under).

The five-year common web mixed ratios for the owners, industrial auto, and property disaster strains of insurance coverage—which encompasses industrial property, and each owners and farmowners multi-peril strains of protection, amongst others—all exceeded the breakeven mixed ratio of 100. The industrial multi-peril line, which largely displays protection written for small- and medium-size industrial enterprises, posted the best common mixed ratio (106.8) throughout that five-year interval and generated a mixed ratio nearly as excessive (104.4) during the last 10 years.

In the course of the 2014-2023 interval, altering climate-related dangers led to extra frequent weather-related occasions, and inflationary pressures on declare prices added to the challenges confronted by insurers underwriting property, industrial auto, and basic legal responsibility strains, which have been sturdy development areas for surplus strains’ insurers. Many normal market insurers have reassessed their danger urge for food and underwriting methods for these protection strains.

Surplus strains’ firms have confirmed adept at opportunistically deciding on the dangers they’re prepared to insure and utilizing their freedom to develop bespoke coverage provisions to provide distinctive merchandise to fulfill the wants of policyholders.

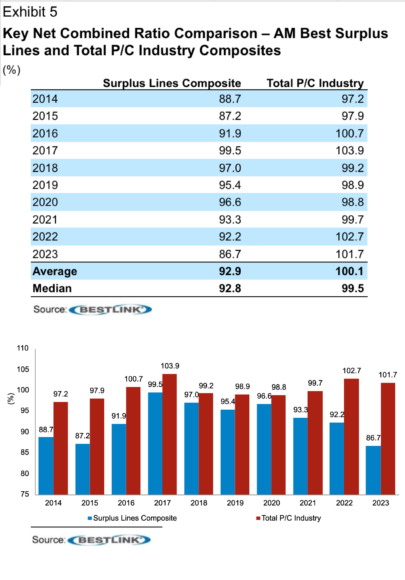

That effectiveness has resulted in surplus strains’ firms, within the mixture, producing superior underwriting outcomes in comparison with the outcomes of the whole P/C business trying by the lens of AM Finest’s surplus strains composite and its whole P/C business composite (see Exhibit 5 under). AM Finest’s surplus strains composite displays the outcomes of firms for which greater than 50% of their enterprise is written on a non-admitted or surplus strains foundation.

Growing Modern Protection Options

The excess strains section has efficiently pivoted throughout difficult situations by adjusting methods, creating revolutionary protection options and modifying enterprise danger administration ideas. These strengths have been important to the market’s enlargement and as carriers undertake practices that usually have led to short-term enhancements throughout tough durations, whereas looking for to determine long-term success.

As companies proceed integrating newer applied sciences similar to generative synthetic intelligence into day by day operations and use new scientific discoveries and instruments of their operations that current new danger exposures, AM Finest believes the position of surplus strains’ insurers will proceed to increase. These insurers will likely be critically necessary to insureds in manufacturing, engineering, development, and different companies that require nimble protection options to guard their companies.

Associated:

Matters

Extra Surplus

Property Casualty