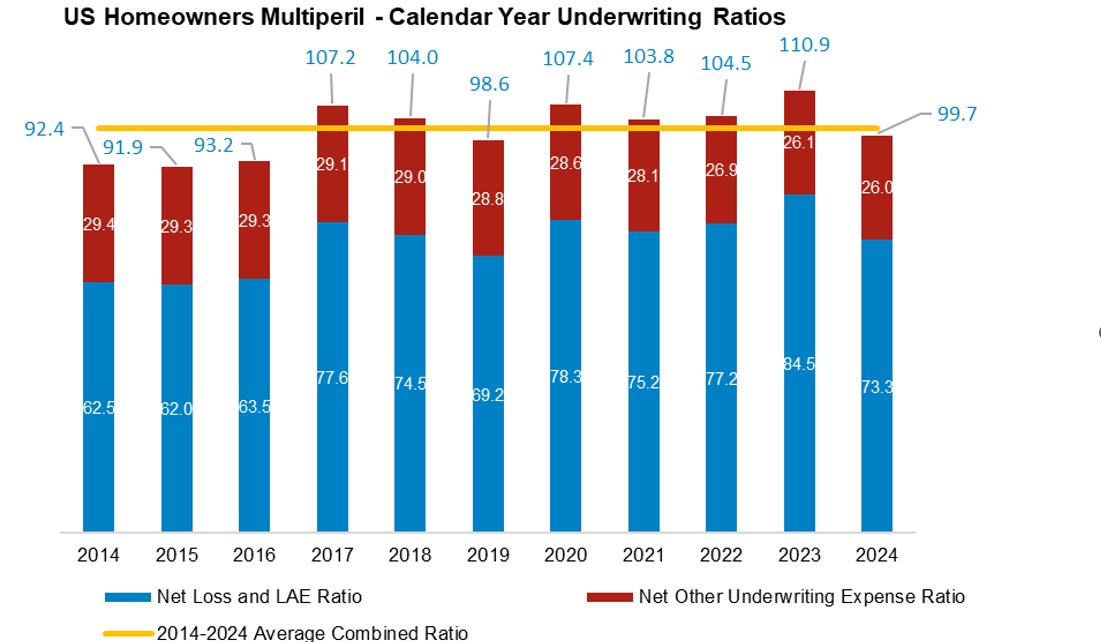

Final 12 months’s sub-100 mixed ratio for the householders line broke a five-year string of 100-plus figures for the U.S. insurance coverage trade in mixture—and householders insurers are sticking to price will increase to maintain earnings going, a brand new report says.

In accordance the report from AM Greatest, “Improved U.S. Householders Outcomes Challenged by January Wildfires,” complete U.S. householders direct premiums written elevated by 10.7% within the first quarter of 2025 in contrast with the identical interval in 2024.

This comes after the phase posted double-digit direct premium will increase in every of the final 4 years. Whereas the ten.7% is decrease than first-quarter 2022, 2023 and 2024 premium boosts, which every averaged round 13%, in 2025, first-quarter premium was virtually $15 billion larger than it was simply 4 years prior in 2021, the report states.

“The rise in direct premium within the first quarter of 2025 exhibits that insurers are persevering with to pursue sufficient premiums so as to set up extra favorable underwriting outcomes for the U.S. householders insurance coverage line relatively than having the marked enchancment in 2024 show to be a one-year phenomenon,” mentioned David Blades, affiliate director, AM Greatest, in a press release in regards to the report.

Which may be a tall order.

Measured in opposition to a full-year 2024 householders internet loss and loss adjustment expense ratio of 77.3, the direct loss ratio for first-quarter 2025 was 102.1—a consequence of the January 2025 California wildfires and billions of {dollars} in losses from a number of twister outbreaks within the Midwest, South and Plains states. (Editor’s Word: The comparability within the prior sentence will not be apples-to-apples. The 102.1 excludes reinsurance recoveries.)

The present 2025 Atlantic hurricane season, which stretches via November 30, will present yet one more check for the way properly insurers have underwritten the dangers that stay of their portfolios, the report notes.

In a media assertion, AM Greatest cited one other potential headwind for insurers—the erosion of the capabilities beforehand supplied by the Nationwide Oceanic and Atmospheric Administration. Noting, for instance, that the NOAA will now not replace a free, public database of $1 billion-plus climate- and weather-related disasters, Greatest mentioned this “might create a essential hole for insurers, brokers, brokers and policyholders that depend on disaster information and data that’s instrumental in pricing, reinsurance planning, and figuring out geographic publicity developments.”

The report additionally delves into the variability of householders underwriting outcomes by service and by state. It consists of an evaluation of the variety of states for which mixed ratios surged previous 100 in every of the previous 10 years, displaying 10 states topping the breakeven ratio in 2024. Additional evaluation within the report provides a comparability of 2014 and 2024 mixed ratios for these 10 states—Nebraska, New Mexico, Georgia, South Carolina, Missouri, Arkansas, Oregon, Illinois, Oklahoma, and North Carolina. All have worsened, with mixed ratios in these state rising 30 factors, on common. (Illinois was an outlier with much less that 1 level of degradation.)

Prime 20 Householders Insurers

Amongst carriers, AM Greatest “believes the phase’s higher performers are simpler at leveraging know-how to boost underwriting, loss prevention, and repair capabilities, notably strengthening the chance choice course of,” the report says, highlighting these actions past vital price exercise and inflation guard changes as a number of the keys to raised underwriting outcomes.

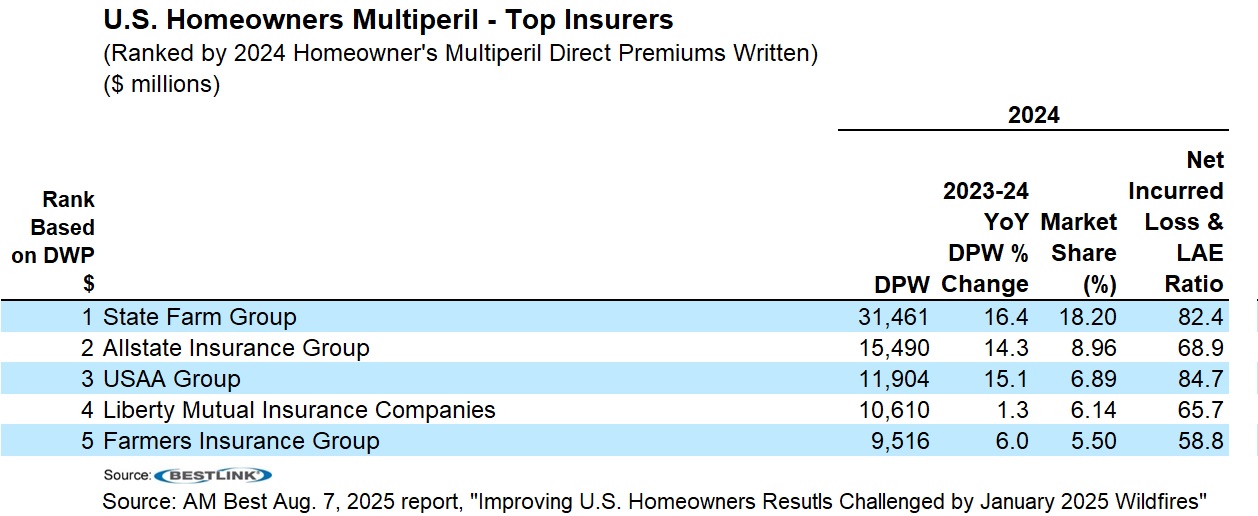

The report features a record of the highest 20 householders insurers by 2024 direct premiums written, together with every service’s 2024 and 2023 direct premiums, market share and internet incurred loss and LAE ratios.

Beneath we’ve got excerpted the highest 5 by 2024 direct premium quantity.

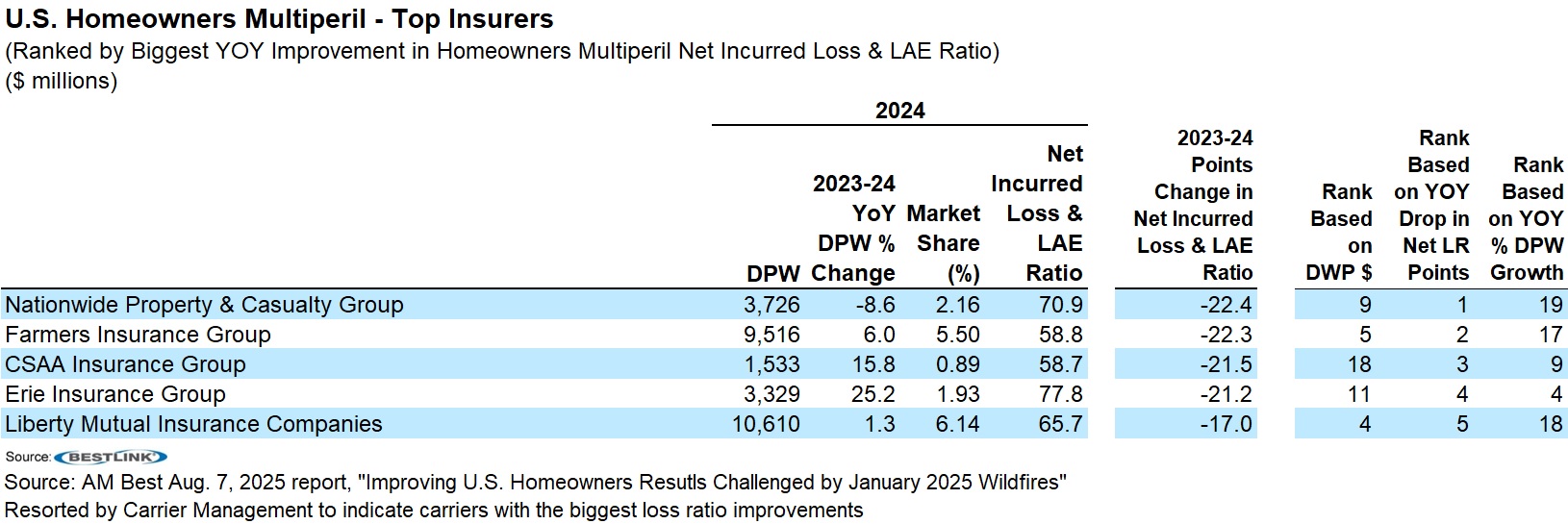

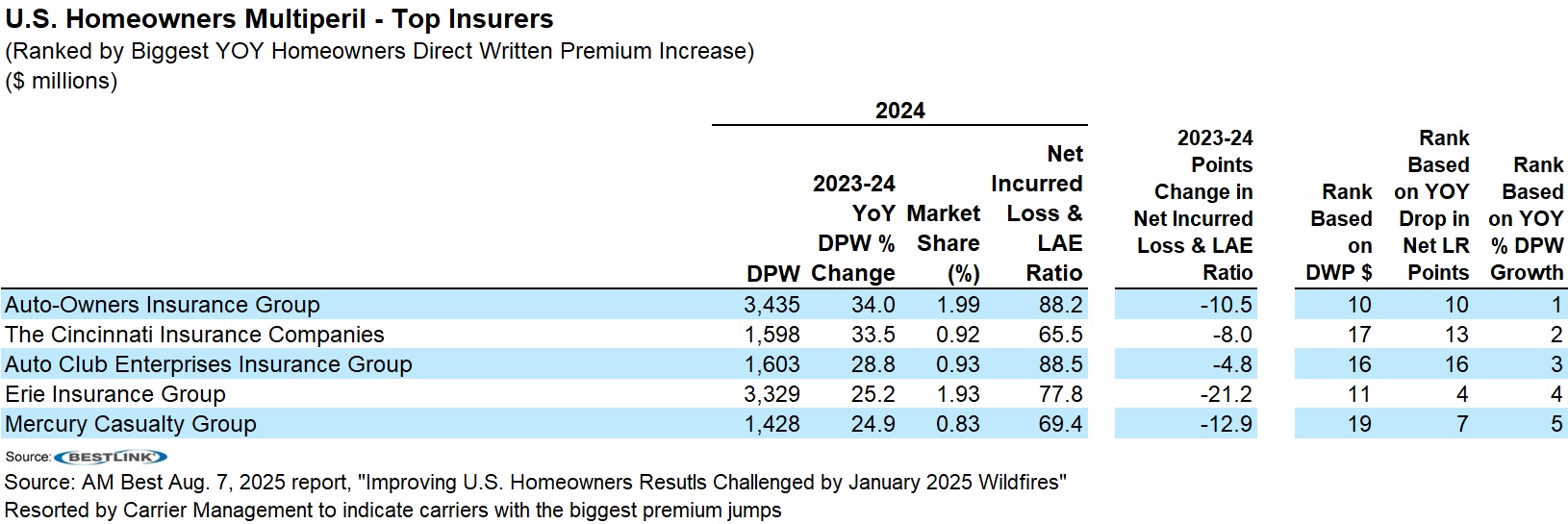

Utilizing year-over-year internet loss & LAE ratio modifications from 2023 to 2024 (calculated by Service Administration from data within the AM Greatest report), and share modifications in direct premium written (calculated by AM Greatest), we additionally present the leaders based mostly on these metrics—the largest enhancements in internet loss & LAE ratios, and the largest share jumps in premiums.

Whereas the premiums are supplied on a direct foundation and loss ratios on a internet (after reinsurance) foundation, presenting some issue in drawing definitive conclusions, it’s noteworthy that three of the carriers within the prime quartile of internet loss ratio enchancment—Nationwide, Farmers and Liberty Mutual—rank within the backside quartile of direct premium progress. Whereas 13 of the highest 20 carriers grew direct premiums by double-digits, Nationwide shrank 8.6% whereas bettering its internet loss ratio greater than 20 factors. Farmers likewise noticed a 22 level drop in its loss ratio from 2023 to 2024, however grew direct premiums by 6%.

Actions by carriers to reshape their books of enterprise by shrinking or exiting some areas along with taking price could have fueled a number of the loss ratio enhancements.

Solely Erie Insurance coverage ranks within the prime quartile for each loss ratio enchancment and premium progress. In the meantime, two writers distinguished within the state of Florida, Residents Property Insurance coverage Company and Common Insurance coverage, had been each within the backside quartile of loss ratio enchancment and premium progress. A depopulating Residents, in truth, reported 15.3% much less direct premiums in 2024 than 2023, however a hurricane-impacted loss ratio of 130.8—greater than 80 factors above 2023.

Among the many prime 5 carriers ranked by direct premium quantity, USAA moved previous Liberty Mutual to take a third-place rating in 2024. USAA’s householders premiums grew 15.1% to $11.9 billion, behind the highest gamers—State Farm and Allstate—which additionally every reported progress within the mid-teens.

Rising twice as a lot final 12 months had been Auto-House owners Insurance coverage Group, The Cincinnati Insurance coverage Firms and Auto Membership Enterprises Group, which all noticed direct written householders premiums up round 30%.

Subjects

Carriers

AM Greatest

Householders